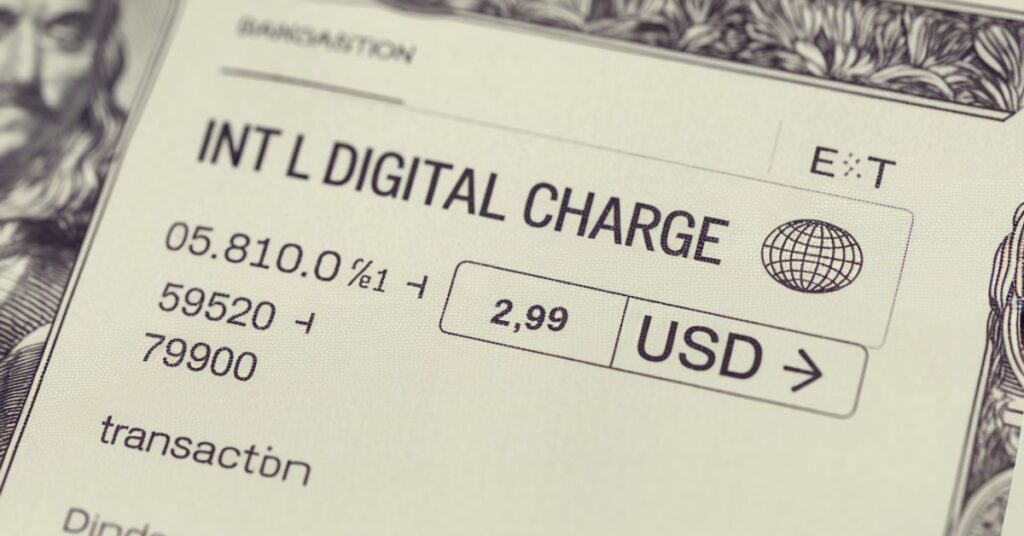

Ever glanced at your bank statement and stumbled upon an unfamiliar charge labeled as “Int l Digital Charge”? It’s not uncommon for people to experience confusion or even panic when they see unexpected fees on their financial records. With the rise of global e-commerce and digital services, international transactions are becoming a regular part of many people’s lives. But what exactly does this charge mean, and how do you address it?

In this article, we will explore everything you need to know about Int l Digital Charges, from what they are, why they appear, and how to stop or dispute them. We’ll also guide you through the membership cancellation process for popular platforms like Weight Watchers, and explain how to better manage online subscriptions to avoid unexpected charges.

What is an Int l Digital Charge?

An Int l Digital Charge refers to fees or transactions that stem from international purchases or services provided by a digital platform. This fee may be applied when you buy something online from a company based in another country or when you subscribe to international digital services like streaming platforms, apps, or memberships.

These charges are usually processed in foreign currencies, which then get converted to your local currency, sometimes resulting in additional fees for currency exchange or international transaction fees.

Read related blog: FID BKG SVC LLC Moneyline on your bank statement?

Why Did the Int l Digital Charge Appear on Your Bank Statement?

If you’re seeing an unexpected Int l Digital Charge on your bank statement, there could be several reasons behind it. It’s important to break down the potential causes to understand whether the charge is legitimate or not.

Common Reasons for an Int l Digital Charge

- International Subscriptions: Services like Weight Watchers, Spotify, or Netflix may trigger international charges, depending on where the company processes your payment.

- Cross-Border Purchases: Any digital services fees paid to vendors outside your country, whether it’s for software or online memberships, can result in these charges.

- Currency Conversion: Sometimes, even if a vendor appears local, your credit card transaction may be processed through an international gateway, causing an extra fee.

Did You Recently Subscribe to an International Service?

Many people unknowingly subscribe to services that process payments abroad, leading to confusion when they see charges labeled as international digital fees. For example, Weight Watchers might have a Weight Watchers transaction fee that appears international due to where their payment processor is located.

How Currency Conversion Plays a Role

Many banks and credit card companies charge extra for currency conversion when you purchase from an international vendor. This often results in a small additional charge tagged as foreign transaction fee or part of the digital services fees.

Case Study: Weight Watchers Transaction

Consider a scenario where a customer from the U.S. subscribes to Weight Watchers through their website. The company processes payments in multiple countries, which could cause the charge to appear as an international digital charge. This situation can arise even though the customer believes they are paying a local company. It’s always a good idea to check with the company’s customer service contact if the charge seems unclear.

How Does an Int l Digital Charge Appear on Your Bank Statement?

Identifying an Int l Digital Charge on your bank statement can be tricky because it often comes with cryptic abbreviations or transaction codes. Let’s break down what to look for when reviewing your bank statement.

What It Might Look Like

- Abbreviations: It may show up as “INT L,” “INTL DIG CHG,” or simply “DIGITAL CHARGE.”

- Vendor Names: The name of the company or platform might be abbreviated or represented differently, such as “WW” for Weight Watchers, or “APPL*” for Apple services.

- Currency Conversion: If you notice a foreign currency or a higher-than-expected charge, it may indicate an additional fee for currency exchange.

Table of Common Abbreviations for International Digital Charges

| Abbreviation | Possible Charge | Explanation |

| INTL DIG CHG | International Digital Charge | Indicates a charge for a digital service from abroad. |

| WW | Weight Watchers | Could indicate a Weight Watchers subscription fee. |

| APPL* | Apple Digital Services | Refers to purchases made via Apple’s digital platforms (App Store, iTunes, etc.). |

| NETFLX | Netflix Subscription | Represents recurring subscription to Netflix. |

| SPOTIFY | Spotify Premium | Charge for Spotify’s premium subscription. |

These codes vary by bank and the payment processor, so always cross-check the vendor and amount to ensure it’s legitimate.

Is an Int l Digital Charge Legitimate?

One of the biggest concerns people have when seeing these charges is whether they’re legitimate or the result of fraudulent activity. Here’s how you can tell the difference.

How to Verify if a Charge is Legitimate

- Check your email: Look for a receipt or confirmation email from the service.

- Review recent subscriptions: Make sure you haven’t signed up for any online membership charges or digital services that could explain the fee.

- Contact the vendor: If you’re unsure, reach out to the company’s customer service contact to clarify the charge.

If you recognize the vendor and amount, the charge is likely legitimate. However, if you don’t, follow these steps to ensure your financial security.

How to Stop or Prevent an Int l Digital Charge

Stopping unexpected Int’l Digital Charges can be simple if you follow a few steps to better manage your subscriptions and payments.

Identifying Recurring Charges

- Review Your Bank Statement: Check for monthly or quarterly charges that seem unfamiliar or international.

- Use Online Tools: Most credit card companies provide online tools where you can track recurring subscription fees and flag suspicious transactions.

Tips to Prevent Unwanted Charges

- Set Alerts: Many banks allow you to set alerts for international charges or fee-based digital services, so you know when they occur.

- Use Virtual Credit Cards: Services like privacy.com offer virtual credit cards, which can be used for free trials or temporary memberships to avoid ongoing charges.

- Prepaid Membership Cards: If you’re trying a service like Weight Watchers, consider using a prepaid membership card to limit the risk of recurring charges.

How to Cancel International Digital Subscriptions

If you’ve identified an international digital subscription you no longer need, here’s how to cancel it:

Cancel via Website

- Log in to Your Account: Use your credentials to access the digital platform.

- Go to Your Profile or Subscription Settings: Most services have an account section where you can manage your subscriptions.

- Follow Cancellation Instructions: Follow the on-screen prompts to confirm cancellation.

- Check Cancellation Policy: Some services may continue billing until the next cycle, even after you cancel.

Cancel via App (iOS or Android)

- Open the App: Navigate to the service you want to cancel (e.g., Weight Watchers).

- Manage Subscription: Head to account settings and select “Subscriptions.”

- Complete Cancellation: Confirm the cancellation and check your email for confirmation.

How to Stop Int l Digital Charges Through Your Bank

If the vendor does not resolve your issue or you are unsure of the charge’s legitimacy, you can stop or dispute the charge through your bank.

Steps to Block Further Charges

- Contact Your Bank: Many banks allow you to block a specific merchant from making future charges.

- Set a Transaction Limit: For recurring charges, set a spending limit to prevent large, unexpected transactions.

How to Dispute Charges

- File a Dispute: Most banks have a straightforward dispute process. Provide the necessary details, such as the date of the transaction and why you believe it’s fraudulent or incorrect.

- Submit Documentation: In some cases, you may need to submit receipts or confirmation emails as evidence.

Chargeback Process

A chargeback is when your bank refunds the transaction while investigating the issue. This can be done if the vendor is unresponsive or if you believe the charge is fraudulent.

You may like also blog: FintechZoom Apple Stock: A Strategic Analysis in 2024

Frequently Asked Questions

What is an Int l Digital Charge?

An Int’l Digital Charge is a fee associated with purchases or services from international vendors, usually for digital products like subscriptions or apps.

Why Do I See This Charge on My Statement?

You might see this charge because you’ve signed up for an international digital platform or service, or because your transaction was processed by an overseas payment gateway.

Can I Stop These Charges?

Yes, you can manage and cancel digital subscriptions or contact your bank to block a specific merchant.

What If I Don’t Recognize the Vendor?

If you don’t recognize the charge, first verify your recent purchases, then reach out to your bank or the vendor for clarification.

Is There a Way to Prevent Future Int l Digital Charges?

You can use tools like virtual credit cards, prepaid membership cards, and set transaction alerts to avoid surprise charges.

Final Words

Understanding Int l Digital Charges can help you take control of your finances, avoid surprise fees, and ensure that your online subscriptions are exactly what you signed up for. Regularly checking your bank statement for unknown charges is a good practice, especially as the digital world continues to grow. Take proactive steps to prevent unwanted fees, and if necessary, be prepared to dispute charges through your bank or card issuer.