Ever wondered if someone who’s living in a property as a life tenant can actually rent it out? Well, it’s a common question, and the answer isn’t as straightforward as you might think. Let’s break it down.

When we talk about life tenancy, we’re essentially referring to a situation where someone has the right to live in a property for the duration of their life.

However, whether they can rent it out depends on various factors, including the terms of the life tenancy agreement and local laws.

So, can a life tenant rent out the property they’re living in? Dive into our ultimate guide to find out everything you need to know about this intriguing question.

Whether you’re a property owner, a prospective tenant, or just curious about real estate matters, we’ve got you covered.

Let’s explore this topic together and shed some light on the complexities of life tenancy and rental arrangements.

Life Tenancy

Life tenancy is when someone gets to live in a property for their whole life. It’s like having a long-term lease, but it lasts as long as they’re alive.

This arrangement can give them stability and a place to call home without worrying about moving. However, it’s important to understand the rules and responsibilities that come with being a life tenant.

Definition And Explanation Of Life Tenancy

Life tenancy is a legal arrangement where a person, called a life tenant, has the right to live in a property for the duration of their life. This right typically ends upon the death of the life tenant. However, the ownership of the property usually belongs to someone else, known as the remainderman.

The life tenant cannot sell or transfer ownership of the property, as it’s usually designated for the remainderman after their passing. Essentially, life tenancy grants the life tenant the privilege of living in the property without full ownership rights.

It’s a unique form of property ownership with specific rules and limitations. Understanding life tenancy is crucial for navigating real estate transactions and legal matters involving property rights.

Rights And Limitations Of A Life Tenant

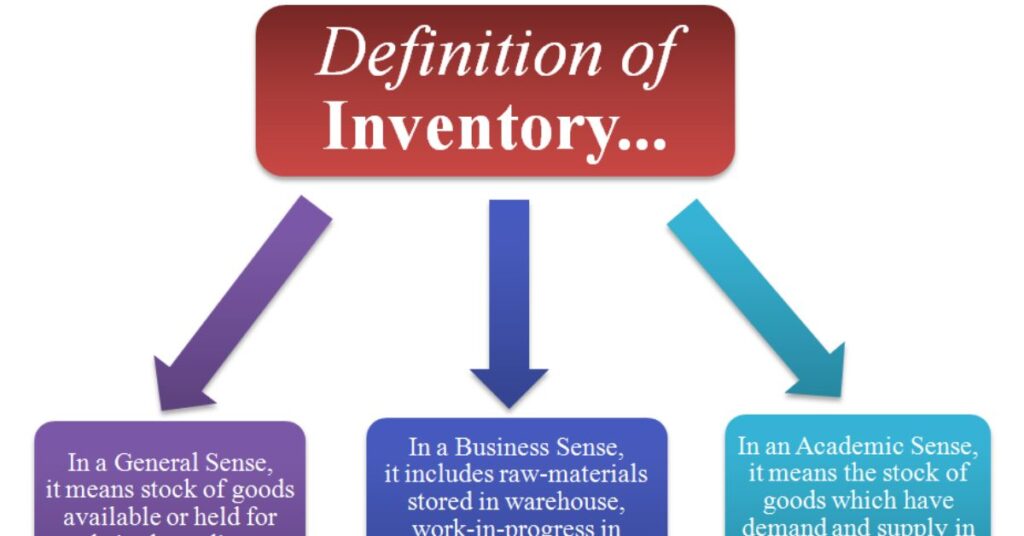

Certainly, here’s a comparison in bullet points:

| Rights of a Life Tenant | Limitations of a Life Tenant |

| Entitled to income generated from the property during their lifetime | Cannot make permanent alterations to the property without permission |

| Can receive any rental income from the property if permitted by the terms of the life tenancy agreement | Cannot mortgage the property or use it as collateral for loans |

| May be entitled to certain tax benefits related to their occupancy | Right to occupy and use the property for life |

| Can make reasonable repairs and maintenance to keep the property in good condition | Must adhere to any conditions or restrictions outlined in the life tenancy agreement |

| May have the right to sublet the property if allowed by the terms of the agreement | Cannot extend the life tenancy beyond their own lifetime |

This table outlines both the rights and limitations that a life tenant typically has when occupying a property.

Top of Form

Renting The Property As A Life Tenant

Renting out a property when you’re a life tenant can be tricky. As a life tenant, you have the right to live in a property for as long as you’re alive.

But can you rent it out to someone else? Well, it depends on many things. First, you need to check the terms of your life tenancy agreement.

Some agreements may allow you to rent out the property, while others may not. Also, local laws play a big role.

They might have rules about renting out properties under life tenancy. It’s essential to understand these rules before making any decisions.

Renting out your property could affect your rights as a life tenant, so it’s crucial to get all the information you need before taking any steps.

The Legality Of Renting The Property As A Life Tenant

Curious about whether it’s legal to rent out a property when you’re living there as a life tenant? Well, legality can be a bit tricky in this scenario.

As a life tenant, you typically have the right to live in the property for your lifetime. However, renting it out might not always be straightforward.

It all depends on various factors like the terms of your tenancy agreement and the laws in your area. Some agreements might allow it, while others might expressly forbid it.

So, before you decide to rent out your place, it’s crucial to carefully review your agreement and seek legal advice if needed. Understanding the legality of renting as a life tenant can help you make informed decisions about your property.

Factors To Consider Before Renting Out The Property

Before renting out your property, there are a few important things to think about. First, make sure you understand local laws and regulations regarding renting.

Next, consider your financial situation and whether renting is the right choice for you. Then, think about the kind of tenant you want and how you’ll manage the property.

Lastly, don’t forget to factor in maintenance and upkeep costs. Taking these factors into account can help ensure a smooth and successful renting experience.

Review the life tenancy agreement

Before signing anything, it’s crucial to review the life tenancy agreement carefully.

This document outlines your rights and responsibilities as a tenant for as long as you live in the property. Take your time to understand the terms to ensure a smooth and fair living arrangement.

Seek permission from the property owner

Before making any changes or decisions regarding the property, always ask the owner for permission.

It’s important to respect their rights and ensure clear communication to avoid misunderstandings.

Taking this step shows responsibility and consideration for the owner’s wishes.

Consider maintenance and repairs

Don’t forget about fixing things and keeping your place in good shape! Maintenance and repairs are important tasks to consider for keeping your home safe and comfortable. Regular upkeep helps prevent bigger problems later on.

Understand tax implications

Understanding tax implications is crucial for managing your finances wisely. It’s about knowing how different financial decisions can affect the taxes you owe.

Whether you’re buying a house, investing in stocks, or starting a business, being aware of tax implications can help you make informed choices and avoid unexpected tax bills.

Insurance coverage

Insurance coverage is like a safety net for your belongings or yourself. It’s a way to protect against unexpected events, like accidents or damage. Having insurance means you won’t have to worry about the costs if something goes wrong.

Rights And Responsibilities Of A Life Tenant

Living as a life tenant comes with both rights and responsibilities. As a life tenant, you have the right to occupy the property for your lifetime.

This means you can call it home and enjoy its benefits. However, you also have responsibilities, like maintaining the property in good condition and following any terms outlined in the life tenancy agreement.

It’s important to understand these rights and responsibilities to ensure a harmonious living arrangement. Let’s delve deeper into what it means to be a life tenant and how to navigate these rights and duties effectively.

The Rights And Responsibilities Of A Life Tenant When Renting The Property

As a life tenant renting a property, you have both rights and responsibilities that are important to understand. Your rights include the right to live in the property for your lifetime, as outlined in the terms of your life tenancy agreement. This means you have a secure place to call home, providing stability and peace of mind.

However, along with these rights come certain responsibilities. One of the primary responsibilities is to maintain the property in good condition.

This includes keeping it clean, making minor repairs, and ensuring that any damages caused by you or your guests are promptly addressed. By taking care of the property, you not only fulfill your obligations as a tenant but also contribute to preserving its value over time.

Another responsibility you have as a life tenant is to abide by the terms of your rental agreement. This means paying rent on time, respecting the property owner’s rules and regulations, and communicating any issues or concerns in a timely manner.

By adhering to these terms, you help foster a positive relationship with the property owner and ensure a harmonious living arrangement for everyone involved.

Additionally, it’s essential to be mindful of your neighbors and the community around you. As a tenant, you have a responsibility to be considerate of others, whether it’s keeping noise levels down, maintaining the exterior of the property, or being respectful of shared spaces.

By being a good neighbor, you contribute to creating a pleasant and supportive living environment for everyone in the community.

Moreover, it’s crucial to understand your rights as a tenant under the law. This includes protections against discrimination, the right to privacy, and the right to a habitable living environment. Familiarizing yourself with these rights can help you advocate for yourself if any issues arise during your tenancy.

In conclusion, as a life tenant renting a property, you have both rights and responsibilities that must be upheld. By fulfilling your obligations, respecting the terms of your rental agreement, and being considerate of others, you can enjoy a positive and fulfilling living experience while also contributing to the well-being of the property and community.

Managing Rental Income As A Life Tenant

Managing rental income as a life tenant can be a bit tricky, but it’s definitely doable with the right approach. As a life tenant, you have the right to live in the property for your lifetime, but renting it out introduces some additional considerations.

First, you’ll need to check your life tenancy agreement to see if it allows for renting. Then, you’ll have to handle tenant selection, maintenance, and rent collection. It’s important to keep detailed records of income and expenses for tax purposes.

Finally, maintaining clear communication with both tenants and any property owners is key to successful income management. With careful planning and organization, you can effectively manage rental income as a life tenant.

Strategies For Managing Rental Income As A Life Tenant

If you’re living in a property as a life tenant, managing rental income can be a smart move. One strategy is to ensure the property is well-maintained to attract tenants. You could also consider hiring a property manager to handle the rental process for you.

Another option is to invest the rental income wisely for your future needs. By staying organized and proactive, you can make the most of your rental income while enjoying the benefits of life tenancy.

Set Clear Rental Terms

- Clearly outline rent amount, due date, and any additional fees in the lease agreement.

- Specify rules regarding pets, maintenance responsibilities, and property use.

- Ensure both parties understand and agree to the terms before signing.

Screen Potential Tenants

- Conduct background and credit checks to assess financial stability and rental history.

- Verify employment and income to ensure tenants can afford the rent.

- Contact previous landlords for references to gauge tenant behavior.

Maintain Regular Communication

- Stay in touch with tenants to address concerns or maintenance issues promptly.

- Provide updates on any changes to rental policies or property conditions.

- Foster a positive landlord-tenant relationship through open and respectful communication.

Keep Expenses and Income Separate

- Maintain separate bank accounts for rental income and property expenses.

- Keep detailed records of all transactions for tax and accounting purposes.

- Avoid co-mingling personal and rental finances to maintain financial clarity and organization.

Maintain Property Value

- Conduct regular inspections to identify and address maintenance issues promptly.

- Invest in necessary repairs and upgrades to enhance the property’s appeal and value.

- Stay informed about market trends and property values to make informed decisions about maintenance and improvements.Tax Implications And Considerations For Life Tenants Renting Out Their Property

Tax Implications And Considerations For Life Tenants Renting Out Their Property

Thinking about renting out your property as a life tenant? It’s important to consider the tax side of things too. When you rent out a property, you might need to pay taxes on the rental income.

Plus, there could be other tax implications to think about, like potential deductions or capital gains taxes when you sell.

So, before you dive into renting out your place, take a moment to understand the tax implications and make sure you’re prepared for whatever comes your way.

Rental Income Tax

Rental income tax is the tax you pay on the money you earn from renting out your property. It’s important to understand how rental income is taxed in your area to avoid any surprises come tax time.

Depreciation

Depreciation refers to the gradual decrease in the value of an asset over time. It’s a common concept in real estate, where properties depreciate due to wear and tear, age, and other factors.

Schedule E

Schedule E is a tax form used by landlords to report rental income and expenses from their properties. It’s an essential document for life tenants who rent out their property, as it helps them accurately report their rental income to the IRS.

Top of Form

Capital Gains

Capital gains are the profits earned from selling an asset, like real estate, for more than its purchase price.

Understanding how capital gains taxes work is crucial for life tenants renting out their property, as it can impact their overall financial situation.

Tax Deductible Expenses

Tax deductible expenses refer to costs associated with maintaining and managing the rental property that can be deducted from your rental income when calculating taxes.

These expenses can include repairs, maintenance, insurance, property management fees, and even mortgage interest payments.

Understanding what expenses are tax deductible can help life tenants maximize their tax benefits while renting out their property.

Rental Arrangements As A Life Tenant

As a life tenant, entering into rental arrangements can be complex. It’s essential to review the terms of your life tenancy agreement carefully and consult legal advice if needed.

Understanding your rights and responsibilities is crucial to ensuring a smooth and legally compliant rental process.

Terminating Rental Agreements As A Life Tenant

As a life tenant, entering into rental arrangements can be complex. It’s essential to review the terms of your life tenancy agreement carefully and consult legal advice if needed.

Understanding your rights and responsibilities is crucial to ensuring a smooth and legally compliant rental process.

Reviewing the rental agreement

attention to clauses regarding rent payment, maintenance responsibilities, and any restrictions on subletting. Understanding the terms of the agreement can help prevent misunderstandings and ensure a smooth tenancy experience.

Providing notice

Providing notice is crucial when a life tenant plans to rent out their property. This typically involves informing any relevant parties, such as the property owner or any governing bodies, about the intention to rent out the property. Providing proper notice ensures transparency and compliance with legal and contractual obligations.

Communicating with your landlord

Open and clear communication with your landlord is key to a smooth and positive renting experience. Whether you have questions about maintenance, need to discuss lease terms, or have any concerns, don’t hesitate to reach out.

Building a good relationship through effective communication can help address issues promptly and ensure a mutually beneficial living arrangement

Completing the necessary paperwork

Completing the necessary paperwork is a crucial step when renting out your property as a life tenant. This paperwork typically includes lease agreements, rental applications, and any legal documents required by local authorities.

Make sure to fill out all forms accurately and thoroughly to ensure a smooth rental process and protect your rights as a landlord.

Returning the property

When the life tenancy ends, returning the property to the owner or their designated beneficiary is typically required.

This involves ensuring the property is in good condition, with any agreed upon repairs completed. Additionally, clear communication between the life tenant and the owner beneficiary is crucial to facilitate a smooth transition and ensure all terms of the agreement are met.

Rights And Obligations When Ending A Rental Arrangement

Ending a rental arrangement involves a set of rights and obligations for both landlords and tenants, governed by legal statutes and the terms of the lease agreement. For tenants, understanding their rights and obligations is crucial to ensure a smooth transition out of the rental property.

- When a tenant decides to end their tenancy, they typically must provide advance notice to the landlord as outlined in the lease agreement or local laws.

This notice period varies depending on the jurisdiction and the terms of the lease but is generally 30 to 60 days.

- Tenants are usually responsible for leaving the rental property in the same condition as when they moved in, with reasonable wear and tear accepted. This often involves cleaning the premises, repairing any damages beyond normal wear and tear, and removing all personal belongings..

- Landlords, on the other hand, have obligations to fulfill when ending a rental arrangement. They must adhere to the terms of the lease agreement and any applicable state or local laws regarding the termination of a tenancy.

- Landlords may also have obligations related to refunding prepaid rent, conducting a final inspection of the property, and addressing any outstanding issues such as returning keys or cancelling utilities in their name.

- In some cases, disputes may arise between landlords and tenants regarding the end of a rental arrangement. Common issues include disagreements over the condition of the property, deductions from the security deposit, or unpaid rent. In such situations, both parties have the right to seek resolution through legal means, such as mediation or small claims court.

- Overall, understanding the rights and obligations involved in ending a rental arrangement is essential for both landlords and tenants. By following proper procedures and communicating effectively, both parties can ensure a fair and orderly transition out of the rental property.

Frequently Asked Questions Of Can A Life Tenant Rent The Property

Which Of The Following Is A Right Provided To A Life Tenant?

A right provided to a life tenant is the right to occupy and use the property for the duration of their life.

What Is The Disadvantage Of A Life Estate?

One disadvantage of a life estate is that the individual granted the life estate cannot sell the property without the consent of the remainderman, potentially limiting their financial flexibility and control over the property.

What Are The Responsibilities Of A Life Tenant In Florida?

In Florida, a life tenant is responsible for maintaining the property, paying property taxes, and ensuring the property is not damaged or neglected.

Can I Rent Out My Life Estate Property In Florida?

Yes, you can rent out your life estate property in Florida, but it’s essential to review the terms of your life estate agreement and comply with local rental regulations.

Conclusion

In conclusion, the question of whether a life tenant can rent out their property is nuanced, with considerations spanning legal, financial, and practical realms. Through our exploration in this ultimate guide, we’ve uncovered the complexities involved in this matter.

While life tenants technically possess the right to inhabit the property for their lifetime, the ability to rent it out depends on various factors such as the terms of the life tenancy agreement, local laws, and the consent of remaindermen or beneficiaries. Understanding these intricacies is paramount for both life tenants and property owners alike.

Moreover, we’ve delved into the tax implications and considerations associated with renting out property as a life tenant, shedding light on potential obligations and pitfalls.

By examining the rights and obligations of both landlords and tenants when ending a rental arrangement, we’ve provided valuable insights for navigating the termination process smoothly and fairly.