Fintechzoom Amazon Stock offers a comprehensive guide for investors seeking insights into Amazon’s performance and potential. This resource delves into the intricacies of Amazon’s stock providing analysis trends and forecasts to aid investors in making informed decisions.

Discover the secrets behind Amazon’s success and uncover opportunities for growth in the stock market. Dive into this comprehensive guide to navigate the complexities of investing in Amazon with confidence and clarity.

Understanding Fintechzoom’s Analysis Approach

Fintechzoom’s analysis approach is characterized by its meticulous blending of quantitative data and qualitative insights. When analyzing Amazon stock Fintechzoom doesn’t solely rely on numerical data but also integrates expert judgment and market insights. This approach ensures a comprehensive evaluation of various factors influencing Amazon’s market performance.

Utilizing advanced algorithms Fintechzoom assesses key metrics such as Amazon’s financial health, growth potential market trends, and competitive positioning. However, what sets Fintechzoom apart is its emphasis on qualitative insights. Experts at Fintechzoom delve deep into industry trends, company strategies and broader economic factors to provide a nuanced understanding of Amazon’s stock dynamics.

Rather than just crunching numbers, Fintechzoom’s analysts interpret the data in the context of the broader market landscape. They consider factors like consumer behavior regulatory changes, and technological advancements to offer insights beyond what can be gleaned from financial statements alone.

Furthermore Fintechzoom’s analysis approach is not static; it evolves with changing market conditions and new developments. Analysts continuously monitor Amazon’s performance, updating their models and insights to reflect the latest information available.

Fintechzoom’s analysis approach combines quantitative rigor with qualitative depth, providing investors with a comprehensive understanding of Amazon’s stock and empowering them to make informed investment decisions.

Read Also(CRYPTO BASTION 25MSHENBLOOMBERG: EXPOSING THE RISKS BEHIND)

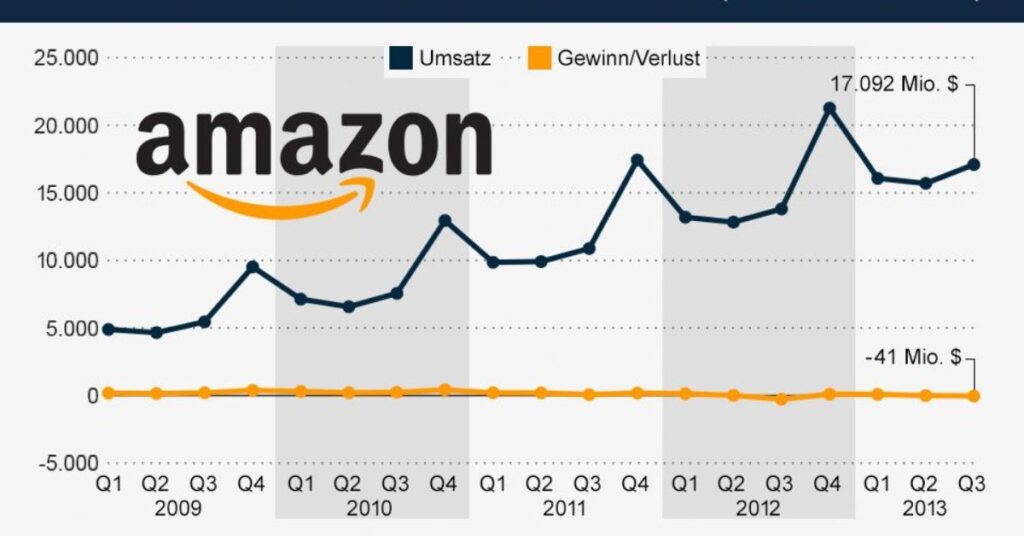

The Dynamics of Amazon Stock

The dynamics of Amazon stock encapsulate its pivotal role in the financial landscape, serving as a barometer of market sentiment and influencing investor decisions worldwide. Amazon’s stock price reflects a myriad of factors including the company’s market positioning growth trajectory and response to external forces such as consumer trends and regulatory changes.

Understanding these dynamics is essential for investors seeking to navigate the ever-changing terrain of the stock market effectively.

Amazon’s stock is characterized by its susceptibility to fluctuations driven by both internal and external factors. Changes in consumer behavior technological advancements and shifts in market trends all contribute to the volatility of Amazon’s stock price. Moreover regulatory developments and geopolitical events can also impact investor sentiment and influence the trajectory of Amazon’s stock.

Despite its volatility Amazon’s stock has demonstrated remarkable resilience and growth over time attracting investors seeking exposure to the e-commerce giant’s innovative business model and expanding market presence.

By staying abreast of the dynamics shaping Amazon’s stock performance, investors can make informed decisions to capitalize on opportunities and mitigate risks in the ever-evolving landscape of the financial markets.

Key Factors Influencing Amazon’s Stock Performance

1. Revenue Growth:

Amazon’s consistent revenue growth across diverse business segments, including e-commerce, cloud computing, and subscription services like Prime, significantly impacts its stock performance. This sustained growth fosters positive investor sentiment and drives upward trends in the stock price.

2. Market Competition:

The intense competition from both traditional retailers and tech giants directly affects Amazon’s market share and profitability. Fluctuations in competitive dynamics often lead to volatility in Amazon’s stock price as investors assess the company’s ability to maintain its competitive advantage.

3. Strategic Initiatives:

Amazon’s strategic initiatives, such as investments in technology, logistics infrastructure, and expansion into new markets, are critical determinants of its long-term growth prospects. These initiatives are closely monitored by investors as they offer insights into Amazon’s future potential and capacity to innovate.

Fintechzoom Analysis:

Fintechzoom conducts in-depth analysis and utilizes advanced algorithms to evaluate these key factors. By providing actionable insights into Amazon’s stock performance, Fintechzoom empowers investors to make informed decisions in navigating the dynamic landscape of the stock market.

Read Also(BINBEX TRADE: MAXIMIZING YOUR INVESTMENT POTENTIAL)

Exploring Investment Opportunities

Identification of Potential Opportunities:

Fintechzoom’s thorough analysis uncovers promising investment prospects within Amazon stock. By spotlighting Amazon’s dominant position in e-commerce expanding ventures in cloud computing and innovative initiatives investors gain insights into the company’s potential for sustained growth.

Through Fintechzoom’s scrutiny these opportunities emerge as compelling avenues for long-term investment, offering investors a chance to capitalize on Amazon’s diversified revenue streams and strategic market positioning.

Long-Term Growth Prospects:

Delving deeper discussions revolve around Amazon’s sustained growth trajectory. With its multifaceted revenue streams and relentless pursuit of innovation Amazon presents robust long-term growth prospects.

By continuously evolving and adapting to market trends Amazon demonstrates resilience and the potential to generate substantial returns for investors over time. Fintechzoom’s analysis provides investors with a comprehensive understanding of Amazon’s growth narrative, enabling them to confidently engage in long-term investment strategies.

Associated Risks:

While opportunities abound Fintechzoom also addresses the associated risks of investing in Amazon. Regulatory scrutiny intensified market competition and operational challenges are among the key risks evaluated.

By acknowledging and assessing these risks investors can make informed decisions regarding their investment portfolios. Fintechzoom’s comprehensive approach equips investors with the necessary insights to navigate the complexities of the market and optimize their investment strategies, balancing potential returns with risk mitigation.

Navigating Market Volatility

Navigating market volatility means dealing with the ups and downs of the stock market. It’s like riding a rollercoaster where prices go up and down unpredictably. To navigate this volatility investors need to stay calm stick to their investment plans, and focus on the long term.

By diversifying their investments and staying informed about market trends, investors can better weather the storm of market fluctuations and make wise decisions to protect their investments.

Leveraging Fintechzoom’s Tools and Resources

Using Fintechzoom’s tools and resources means taking advantage of the helpful stuff they offer. It’s like having a toolbox full of gadgets to help with investing. By using these tools, investors can analyze stocks track market trends and make smarter decisions about their money.

Whether it’s using charts to visualize data or reading expert analysis leveraging Fintechzoom’s tools and resources can empower investors to manage their finances more effectively and achieve their investment goals.

Case Studies and Success Stories

Case studies and success stories are like real-life examples of how things worked out well. They show how people or companies faced challenges and found solutions that led to success. By reading these stories we can learn valuable lessons and get inspired to overcome our own obstacles. Case studies and success stories can help us understand what works and what doesn’t in different situations, making it easier for us to achieve our goals and dreams.

Conclusion

Serves as a valuable resource for investors seeking insights into the complexities of Amazon’s stock. Through meticulous analysis Fintechzoom provides a nuanced understanding of key factors influencing Amazon’s performance from revenue growth to market competition and strategic initiatives. By leveraging Fintechzoom’s tools and resources investors can navigate market volatility with confidence capitalizing on investment opportunities while mitigating associated risks.

Additionally, case studies and success stories offer practical examples of effective investment strategies, inspiring investors to make informed decisions and achieve their financial goals. Overall, Fintechzoom’s comprehensive guide equips investors with the knowledge and tools needed to navigate the dynamic landscape of Amazon stock successfully.

FAQ’S

How to buy Amazon stock for beginners?

Beginners can buy Amazon stock by opening a brokerage account and placing an order through the broker’s platform.

Can I buy Amazon stock directly from Amazon?

No, Amazon does not offer direct stock purchase plans for individual investors.

Is AMZN a buy right now?

Determining if AMZN is a buy right now depends on various factors like individual investment goals and market conditions. It’s essential to conduct thorough research before making any investment decisions.

What is Amazon’s direct stock purchase plan?

Amazon does not currently offer a direct stock purchase plan (DSPP) for individual investors. Instead, investors can buy Amazon stock through brokerage accounts with licensed brokerage firms or online trading platforms.

What is Fintechzoom’s approach to analyzing Amazon stock?

Fintechzoom employs a comprehensive approach, blending quantitative data and qualitative insights.

What are some key factors that influence Amazon’s stock performance?

Some key factors influencing Amazon’s stock performance include revenue growth across diverse business segments, market competition, strategic initiatives, and broader market trends.

What are some potential investment opportunities in Amazon stock?

To navigate market volatility when investing in Amazon, diversify your portfolio and focus on the long term.

What tools and resources does Fintechzoom offer for analyzing Amazon stock?

Fintechzoom offers a comprehensive suite of tools and resources for analyzing Amazon stock including advanced algorithms, expert analysis, market insights, and real-time data visualization tools.