Klarna, the popular buy-now-pay-later (BNPL) service, has been making waves in the credit world, and consumers are increasingly wondering, “Does Klarna affect your credit score?” The answer is yes, it can – and in this comprehensive article, we’ll explore how Klarna’s reporting to credit agencies like Experian and TransUnion could impact your credit profile.

What Is Klarna?

For those unfamiliar, Klarna is a Swedish fintech company that pioneered the BNPL concept, allowing shoppers to pay for their purchases in interest-free installments or defer payment for a set period. It has become increasingly popular, especially among younger consumers seeking flexible payment options.

What Does Klarna Report To Credit Agencies And Why?

In June 2022, Klarna announced that it would start sharing customer data with credit reference agencies Experian and TransUnion in the UK. This move was seen as a self-regulation measure to appease regulators and prevent stricter oversight of the BNPL industry.

The data shared by Klarna includes information on purchases, late payments, and unpaid purchases. This means that your Klarna activity can now potentially affect your credit score – both positively and negatively.

How Can Klarna Affect Your Credit Score?

If you make timely repayments to Klarna, it could help improve your credit score. Responsible use of BNPL services like Klarna demonstrates your ability to manage credit effectively, which is viewed favorably by lenders.

However, if you miss payments or fail to repay Klarna on time, it could negatively impact your credit score. Late or missed payments are red flags for lenders, indicating a potential risk of default.

It’s important to note that Klarna’s impact on your credit score may vary depending on the credit reference agency and the scoring model used by lenders.

Why Is Klarna Now Reporting This Information?

Klarna’s decision to share customer data with credit agencies is part of a broader trend within the BNPL industry. As these services have grown in popularity, regulators and consumer advocacy groups have raised concerns about the potential risks associated with unregulated lending.

By voluntarily reporting data to credit agencies, Klarna is attempting to demonstrate transparency and responsible lending practices. This move could also help the company attract a wider range of customers, including those who value a strong credit score.

Does Klarna Run A Credit Check?

When you sign up for Klarna, the company typically performs a soft credit check, which does not impact your credit score. However, if you apply for Klarna’s financing option (which allows you to spread payments over a longer period), the company may perform a hard credit check, which could temporarily affect your score.

It’s important to note that Klarna’s credit checks are generally less extensive than those performed by traditional lenders, as the company primarily focuses on analyzing your ability to repay the specific purchase amount.

Does Klarna Show On Your Credit File?

Yes, as of June 2022, Klarna started reporting customer data to Experian and TransUnion in the UK. This means that your Klarna activity, including purchases, late payments, and unpaid balances, can now appear on your credit file.

However, it’s worth noting that not all lenders may view Klarna activity in the same way. Some may consider it a positive sign of responsible credit management, while others may perceive it as an additional debt obligation.

Does Klarna Build Credit?

While Klarna’s reporting to credit agencies can potentially affect your credit score, it’s not necessarily designed as a credit-building tool. The primary purpose of Klarna is to provide flexible payment options for online purchases.

However, if you consistently make on-time payments to Klarna, it could help establish a positive payment history, which is one of the key factors in determining your credit score. This could indirectly contribute to building your credit over time.

What Is Klarna Financing And How Could This Affect My Credit Score?

Klarna offers a financing option that allows you to spread the cost of your purchase over a longer period, typically up to 36 months. This option is subject to a hard credit check, which can temporarily impact your credit score.

If you choose Klarna financing and make timely payments, it could positively affect your credit score by demonstrating your ability to manage credit responsibly. However, missed or late payments on Klarna financing could have a negative impact on your credit score.

Why Does My Credit Score Matter?

Your credit score is a critical factor that lenders consider when evaluating your creditworthiness for various financial products, such as mortgages, personal loans, and credit cards. A higher credit score generally indicates a lower risk of default, which can lead to more favorable terms and interest rates.

Additionally, landlords, employers, and even utility companies may check your credit score to assess your financial responsibility. A poor credit score could limit your access to housing, employment opportunities, and essential services.

Should You Still Use Klarna?

While Klarna’s reporting to credit agencies means that your usage of the service can now potentially affect your credit score, it doesn’t necessarily mean you should avoid using it altogether. As with any credit product, the key is to use Klarna responsibly and make timely payments.

If you’re confident in your ability to manage Klarna payments effectively, it can still be a useful tool for flexible financing and budgeting purposes. However, if you’re prone to missing payments or overspending, it may be wise to exercise caution or seek alternative payment methods.

What Are Better Ways To Build Credit?

If your primary goal is to build or improve your credit score, there are several alternative strategies that may be more effective than relying solely on Klarna:

Use Credit Cards Responsibly

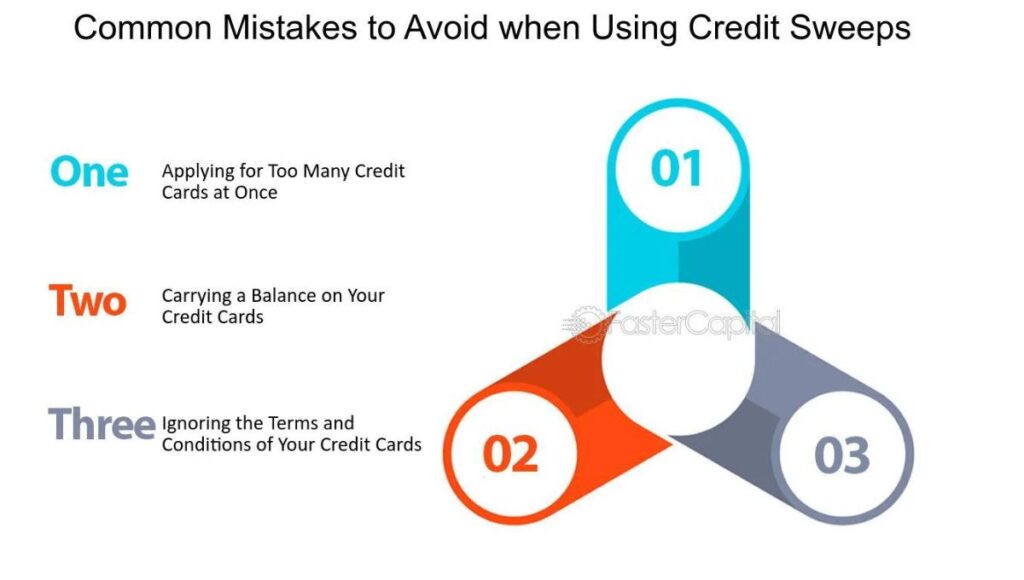

Credit cards remain one of the most reliable ways to build credit when used responsibly. Make sure to keep your credit utilization low (ideally below 30% of your total credit limit) and make payments on time each month.

Consider Credit-Building Cards

If you’re new to credit or have a poor credit history, consider applying for a credit-building card specifically designed for those with limited or poor credit. Options like Aqua, Vanquis, and Capital One offer credit-building products that can help you establish or rebuild your credit profile.

Monitor Your Credit Reports

Regularly check your credit reports from agencies like Experian, Equifax, and TransUnion to ensure accuracy and identify any potential errors or fraudulent activities that could be dragging down your score.

Become an Authorized User

If a family member or trusted friend has a good credit history, you could ask them to add you as an authorized user on their credit card account. This can help build your credit history without requiring you to open a new account.

Use Chrome Extensions or Apps

Various Chrome extensions and mobile apps, such as Claro, can help you monitor your credit score and provide personalized tips for improving it.

Read This Blog

Consider Interest-Free Credit Cards

If you’re looking to consolidate debt or make a large purchase, consider applying for an interest-free credit card from a high street bank. These cards typically offer 0% interest for an introductory period, which can help you manage debt while building credit.

Maintain Low Credit Utilization

One of the most significant factors in your credit score is your credit utilization ratio – the amount of credit you’re using compared to your total available credit. Aim to keep your credit utilization below 30% for the best impact on your score.

Make Timely Payments

Payment history is another crucial factor in determining your credit score. Ensure that you make at least the minimum payment on all your credit accounts by the due date to avoid negative marks on your credit report.

Register on the Electoral Roll

Being registered on the electoral roll can help verify your identity and address, which can positively impact your credit score.

Use Credit-Monitoring Services

Services like Experian’s CreditExpert, Clearscore, and Checkmyfile can help you monitor your credit score and provide personalized recommendations for improving it.

Avoid Applying for Too Much Credit at Once

Each credit application results in a hard inquiry on your credit report, which can temporarily lower your score. Space out your credit applications to minimize the impact on your score.

Be Patient

Building credit takes time, so be patient and consistent with responsible credit habits. Over time, your credit score should improve as long as you maintain a positive payment history and manage your credit utilization effectively.

Remember, while Klarna can be a convenient payment option, it’s essential to use it judiciously and prioritize your overall credit health. By employing a combination of the strategies mentioned above, you can work towards building a strong credit profile that opens doors to better financial opportunities in the future.

When it comes to credit scores, knowledge is power. Stay informed, use credit responsibly, and don’t hesitate to seek professional advice if you’re unsure about the best path forward for your specific situation.

2024 Update:

Klarna’s Credit Impact In 2024

As we move into 2024, Klarna’s reporting to credit reference agencies like Experian, TransUnion, and Equifax has become more widespread and consistent across different markets. This increased transparency has led to a better understanding of how Klarna usage can affect credit scores.

In the UK, where Klarna first started sharing data in 2022, the impact on credit scores has become more pronounced. Consumers who have consistently made on-time payments to Klarna have seen their credit scores improve, while those with late or missed payments have faced negative consequences.

However, it’s important to note that the degree of impact can vary depending on the individual’s overall credit profile and the specific scoring models used by lenders and credit reference agencies.

Bnpl Industry Regulation

In response to the growing popularity of buy-now-pay-later (BNPL) services like Klarna, governments around the world have been working on introducing regulations to ensure consumer protection and responsible lending practices.

The UK government has taken the lead in this area, with the Financial Conduct Authority (FCA) introducing new rules for BNPL providers in 2023. These rules require providers to conduct affordability checks, provide clear information about late payment fees, and report missed payments to credit reference agencies.

Similar regulations are being considered in other countries, including the United States, Australia, and several European nations, as policymakers aim to strike a balance between fostering innovation and protecting consumers.

Impact On Credit Scores Globally

As Klarna and other BNPL providers expand their operations globally, their impact on credit scores is becoming more widespread. In markets where Klarna has established data-sharing agreements with local credit reference agencies, consumers are starting to see the effects of their BNPL usage on their credit reports and scores.

For example, in the United States, where Klarna began reporting to major credit bureaus like Experian and TransUnion in late 2023, responsible usage of Klarna can now contribute to building a positive credit history, while late or missed payments may negatively impact credit scores.

Bnpl And Credit Card Interactions

One area of ongoing discussion is the interaction between BNPL services like Klarna and traditional credit card usage. Some lenders and credit scoring models may view high BNPL usage as an additional debt obligation, potentially affecting credit utilization calculations and risk assessments.

As a result, consumers who heavily rely on BNPL services while also carrying significant credit card balances may see a negative impact on their credit scores, even if they make timely payments on both fronts.

Responsible Use Remains Key

As Klarna’s impact on credit scores becomes more widespread and pronounced, the importance of responsible usage cannot be overstated. Consumers should approach BNPL services like Klarna with the same level of caution and prudence as they would with traditional credit products.

Failing to make payments on time or overextending oneself with multiple BNPL arrangements can quickly lead to negative consequences for one’s credit profile, potentially making it harder to access credit or secure favorable terms in the future.

Credit Education And Monitoring

In light of these developments, there is a growing need for consumer education and credit monitoring services to help individuals understand the implications of their financial decisions, including the use of BNPL services like Klarna.

Companies like Money Saving Expert, Money Supermarket, and Compare The Market have expanded their offerings to include guidance and tools for managing BNPL usage and its impact on credit scores.

Credit monitoring services like Experian, Clearscore, and Checkmyfile have also incorporated BNPL data into their platforms, allowing consumers to track their credit scores and identify potential issues related to BNPL usage.

Looking Ahead

As the BNPL industry continues to evolve and regulations take shape, the impact of services like Klarna on credit scores is likely to become even more significant.

Consumers will need to stay informed and vigilant, utilizing credit monitoring tools and seeking professional advice when necessary to ensure that their BNPL usage aligns with their overall financial goals and credit health.

While Klarna and other BNPL services can offer convenience and flexibility, it’s crucial to approach them with caution and integrate them into a broader strategy for responsible credit management.

Conclusion

As Klarna’s impact on credit scores becomes more widespread, responsible usage is crucial. Consumers should approach BNPL services like traditional credit products, making timely payments and avoiding overextension. Failing to do so can lead to negative consequences for one’s credit profile.

Education and credit monitoring tools are increasingly important to understand the implications of BNPL usage. While convenient, BNPL services like Klarna should be integrated into a broader strategy for responsible credit management. Staying informed, vigilant, and seeking professional advice when needed can help ensure BNPL aligns with overall financial goals and credit health.