When it comes to financial planning and protecting your wealth, having a Lasting Power of Attorney (LPA) for Investments in place is one of the most critical steps you can take. Whether you’re looking to safeguard your assets from potential mismanagement or planning for the future in case of incapacitation, an LPA can help secure your investments and ensure your financial future is protected.

This guide provides a comprehensive overview of what a Lasting Power of Attorney is, why it’s important for your investment portfolio, and how to set one up in the USA. You’ll also learn about the legal requirements, safeguards, and potential risks involved.

What is a Lasting Power of Attorney (LPA) for Investments?

A Lasting Power of Attorney for Investments is a legal document that grants someone you trust known as your attorney-in-fact the authority to manage your investments and financial affairs if you become incapacitated or are unable to make decisions for yourself. This individual takes on the fiduciary duty to act in your best interest, making it a powerful tool for protecting your financial security.

Unlike a general power of attorney, an LPA continues to be valid even if you lose mental capacity, which is why it’s also known as a durable power of attorney in many cases. This ensures that your financial decisions and investment strategies can continue seamlessly, no matter what happens to your health.

Read Also Blog: The Exploring Exponential Growth USA Property Market: Money6x Real Estate

Why It’s Important for Your Investment Portfolio

Managing an investment portfolio involves making strategic decisions, monitoring market conditions, and adapting to changes. If you are unable to do this due to illness or an accident, the absence of an LPA can lead to significant market volatility and even financial losses.

By designating a trusted person to manage your assets, you’re taking steps to protect your financial future. Without an LPA, your family may need to apply for guardianship or conservatorship, which can be time-consuming, costly, and emotionally taxing.

Common Scenarios That Trigger the Need for an LPA

Here are a few situations where having an LPA for Investments is invaluable:

- Incapacitation due to Alzheimer’s dementia: A 2021 study by the Alzheimer’s Association found that nearly 6.2 million Americans live with Alzheimer’s. As the disease progresses, the ability to manage financial affairs diminishes. An LPA ensures that financial mismanagement doesn’t become an issue.

- Unexpected accidents: Sudden injuries can incapacitate you, leaving your financial matters in limbo if there’s no LPA in place.

- Travel or extended absence: If you travel for extended periods, having someone manage your investments can prevent missed opportunities or critical decisions being delayed.

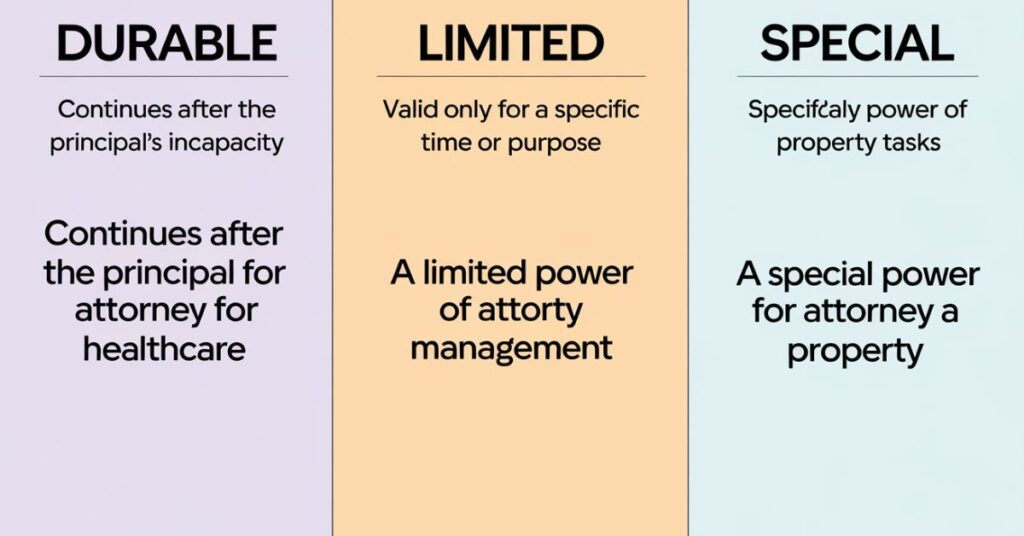

Types of Powers of Attorney in the USA

Understanding the different types of powers of attorney (POA) available in the USA will help you decide which one is best suited for your needs.

General Power of Attorney

A general power of attorney gives your attorney-in-fact authority over all your financial affairs. However, it’s only valid while you have the mental capacity to make decisions. Once incapacitated, it becomes void, which makes it less useful for long-term financial planning.

Durable Power of Attorney for Finances

A durable power of attorney for finances stays in effect even if you become mentally or physically unable to make decisions. This type of POA is similar to an LPA but may cover broader aspects of financial management beyond investments.

Lasting Power of Attorney (LPA) for Investments

The LPA for Investments is specific to managing your investment portfolio. It can include authority to:

- Trade stocks, bonds, or real estate

- Adjust your investment strategy based on market volatility

- Make decisions about retirement funds and other long-term assets

- Rebalance your portfolio to align with your risk tolerance

When to Use Each Type of Power of Attorney

- General POA: Ideal for short-term or specific financial matters, such as signing contracts or handling a property sale.

- Durable POA: Suitable for long-term management of broad financial matters but may not offer the same level of detailed control as an LPA for Investments.

- LPA for Investments: Best for those with significant investment holdings who want to ensure their portfolio is managed according to their wishes, even if they become incapacitated.

Choosing the Right Attorney-in-Fact

Selecting an attorney-in-fact is one of the most critical decisions in setting up a Lasting Power of Attorney for Investments. This individual will have the authority to make financial decisions that can significantly impact your future, so they must be both trustworthy and knowledgeable about investments.

Qualities to Look For in an Attorney-in-Fact

- Trustworthiness: Above all, your attorney-in-fact must have unquestionable integrity. This person will be responsible for safeguarding your assets and making decisions that could affect your family’s financial well-being.

- Financial Acumen: Choose someone with a solid understanding of investment management and financial institutions. They should be able to adapt to market volatility and make informed decisions about your investment portfolio.

- Fiduciary Responsibility: Your attorney-in-fact has a fiduciary duty to act in your best interest, making decisions that align with your financial goals and investment strategy.

- Emotional Stability: Managing someone else’s financial affairs can be stressful, especially in times of crisis. Your attorney-in-fact must remain calm and rational.

Can You Appoint Multiple Attorneys-in-Fact?

Yes, you can appoint co-agents to act as your attorneys-in-fact. This can be beneficial if you want to divide responsibilities or have checks and balances in place. For example, one agent could manage your real estate investments while another handles stocks and bonds. However, having multiple agents can also lead to conflicts, so it’s important to clearly outline their roles in the power of attorney document.

Legal Requirements for Setting Up a Lasting Power of Attorney for Investments in the USA

Creating a Lasting Power of Attorney for Investments involves a few key steps and legal requirements. It’s essential to follow the guidelines in your state to ensure the document is valid.

Legal Process and Documentation

- Drafting the Document: You can either hire an attorney or use a state-approved template to draft your LPA. Make sure to specify the powers you are granting, including the authority to manage investments.

- Signing Requirements: In most states, you’ll need to sign the document in front of a notary public and have at least one witness present.

- State-Specific Laws: Each state has different laws governing powers of attorney. For example, California requires notarization, while Florida mandates both notarization and two witnesses.

Costs of Setting Up an LPA

The costs associated with setting up an LPA can vary depending on your location and whether you use a lawyer. Expect to pay between $200 and $500 for attorney services, plus additional fees for notarization and filing if required.

| State | Witness Requirement | Notarization | Fees |

| California | 1 witness | Yes | $200 – $500 |

| New York | 2 witnesses | Yes | $250 – $600 |

| Florida | 2 witnesses | Yes | $300 – $700 |

Safeguarding Your Investments

When granting powers to an attorney-in-fact, it’s important to implement safeguards that protect your financial management from misuse or mismanagement. Here are some critical considerations:

Key Considerations When Drafting the LPA

- Define Specific Powers: Be clear about what financial actions your attorney-in-fact can and cannot take. For instance, you may want to limit their ability to sell property or make high-risk investments.

- Set Risk Tolerance: Ensure that your LPA includes guidelines on your preferred investment strategy and risk tolerance. You can stipulate that your portfolio should be managed conservatively or require approval for large, risky investments.

- Co-Signatures: Require a second signature for significant decisions, such as selling property or liquidating retirement funds. This adds a layer of protection against mismanagement.

Monitoring and Reporting Requirements

Establish regular reporting requirements to monitor your attorney-in-fact’s activities. You can request quarterly reports or require that your investment portfolio be reviewed by a third-party auditor annually.

Common Safeguards Against Misuse

- Third-Party Oversight: Appoint a financial advisor or family member to monitor the attorney-in-fact’s decisions.

- Restricted Powers: Limit their authority to certain types of investments or cap the amount they can withdraw without additional approval.

- Periodic Reviews: Have the LPA reviewed every few years to ensure it still aligns with your financial goals.

Potential Risks of Lasting Power of Attorney for Investments

While an LPA provides invaluable protection, it’s not without its risks. Mismanagement, fraud, and market volatility are just a few potential pitfalls.

Common Pitfalls

- Conflict of Interest: Your attorney-in-fact may face situations where their personal financial interests conflict with yours.

- Mismanagement of Assets: Without proper oversight, your investments could be mishandled, leading to losses.

- Family Disputes: Appointing an attorney-in-fact can sometimes lead to disputes among family members, especially if they feel excluded from decisions.

Mitigation Strategies

- Regular Audits: Schedule third-party audits to review the attorney-in-fact’s decisions and ensure they are acting in your best interest.

- Appointing a Successor: Designate a successor attorney-in-fact who can take over if the first one is unable or unwilling to continue.

Real-World Case Studies

Case Study 1: The Smith Family Trust

The Smith Family Trust is a well-known example of a family successfully using a Lasting Power of Attorney to manage a significant investment portfolio. When John Smith was diagnosed with early-onset Alzheimer’s, his wife, Sarah Smith, became his attorney-in-fact. By utilizing an LPA, Sarah was able to manage their investments without court intervention, ensuring the family’s financial stability.

Case Study 2: Financial Ruin Without Proper Planning

On the other hand, the Doe family failed to establish an LPA before the head of the household suffered a stroke. Without an LPA in place, the family had to go through court-appointed guardianship, which led to costly legal battles and missed investment opportunities

Securing Your Financial Future with a Lasting Power of Attorney for Investments

A Lasting Power of Attorney for Investments is an essential component of any solid financial planning strategy. It provides peace of mind knowing that your financial future is secured, even in the face of unexpected events like Alzheimer’s dementia or accidents.

By setting up an LPA, you’re taking proactive steps to protect your assets and ensure that your investment portfolio continues to align with your financial goals. Remember, it’s not just about securing wealth—it’s about preserving it for future generations.

Don’t miss out this vlog: “Why Mba” Answer For Experienced Professionals – Notesmama

FAQs

What happens if I become incapacitated without an LPA?

Without an LPA, your family may need to apply for court-appointed guardianship or conservatorship, which can be a lengthy and costly process.

Can I limit the powers given to my attorney-in-fact?

Yes, you can specify exactly what powers your attorney-in-fact has over your investments.

How often should I review or update my LPA?

It’s a good idea to review your LPA every 3-5 years or after any major life changes.

Can I revoke a Lasting Power of Attorney for Investments?

Yes, as long as you have the mental capacity, you can revoke or amend your LPA at any time.

What happens if my attorney-in-fact misuses my investments?

If your attorney-in-fact breaches their fiduciary duty, legal action can be taken to recover any losses or mismanaged assets.

Conclusion

Setting up a Lasting Power of Attorney for Investments is a vital step in safeguarding your financial future. By appointing a trusted attorney-in-fact to manage your assets and investment decisions, you ensure that your portfolio remains stable and aligned with your financial goals, even if you become incapacitated. This legal document grants peace of mind, knowing your estate plan is secure and your family won’t face the burden of navigating the complexities of court-appointed guardianship or conservatorship.