The CCI CARE.COM charge on your bank statement is a fee associated with services from Care.com, a platform for finding caregivers and services. It may include membership or transaction fees. Understanding this charge helps track expenses related to caregiving or household services.

Hook: Ever spotted a mysterious charge labeled “CCI CARE.COM” on your bank statement? Wonder no more! Let’s unveil the mystery behind this enigmatic entry and discover what it entails for your financial records.

What is CCICare.com?

CCICare.com is an online platform connecting people with caregivers for various needs. Users can find babysitters, tutors, pet sitters, and senior care providers. It offers caregiver profiles, reviews, and background checks for peace of mind.

Flexible scheduling options cater to specific requirements. The platform facilitates communication between caregivers and families for better coordination. Managing payments and scheduling is convenient through the online platform or mobile app. CCICare.com also provides resources and support, including articles, tips, and community forums, fostering a supportive caregiving community.

- CCICare.com is an online platform connecting caregivers with individuals and families.

- Users can find caregivers for various needs, including babysitting, tutoring, pet care, and senior care.

- The platform offers caregiver profiles, reviews, and background checks to help users make informed decisions.

- Flexible scheduling options allow users to find caregivers that match their specific requirements and availability.

- CCICare.com facilitates communication between caregivers and families, enabling easy coordination of schedules, tasks, and expectations.

- Payments and scheduling can be managed conveniently through the online platform or mobile app.

- Resources and support are available for both caregivers and families, including articles, tips, and community forums.

- CCICare.com aims to foster a supportive and informed caregiving community by providing valuable resources and facilitating communication.

Read About(https://businessquasar.com/what-does-tst-mean-on-your-credit-card-statement/)

Why did CCI CARE.COM charge me?

The CCI CARE.COM charge on your bank statement typically occurs when you’ve used services from Care.com, a platform connecting people with caregivers. This charge may include membership fees, background check costs, or payments to caregivers.

If you’ve signed up for Care.com’s services or hired a caregiver through their platform, you might see this charge. It’s essential to review your account activity to ensure the charge is legitimate and matches the services you’ve used.

Sometimes, if you’ve forgotten about a subscription or didn’t cancel a trial period, you may still incur charges. Care.com usually sends notifications about upcoming charges and subscription renewals via email.

To avoid unexpected charges, regularly check your bank statements and review any subscriptions or services you’re signed up for. If you believe the charge is incorrect or unauthorized, contact Care.com’s customer support for assistance.

Understanding why CCI CARE.COM charged you helps manage your finances better and ensures transparency in your transactions with the platform.

CCI CARE.COM Charge: What is it and Why is it on Your Bank Statement?

The CCI CARE.COM charge on your bank statement is a fee for using Care.com’s services, like finding caregivers or household help. It appears when you’ve subscribed to Care.com or hired a caregiver through their platform. This charge covers membership fees, background checks, or payments to caregivers. Review your account to ensure the charge matches the services you’ve used. Understanding this charge helps you track expenses related to caregiving or household services.

What are the benefits of using CCI CARE.COM?

Using CCI CARE.COM offers several benefits for individuals and families. Firstly, it provides access to a wide network of caregivers, including babysitters, tutors, pet sitters, and senior care providers, making it easier to find suitable help for various needs.

Secondly, the platform allows users to view caregiver profiles, reviews, and background checks, ensuring peace of mind when selecting someone to care for loved ones. Additionally, CCI CARE.COM offers flexible scheduling options, allowing users to find caregivers that match their specific requirements and availability.

Moreover, the platform facilitates communication between caregivers and families, enabling easy coordination of schedules, tasks, and expectations. Another benefit is the convenience of managing payments and scheduling through the online platform or mobile app.

Lastly, CCI CARE.COM offers resources and support for both caregivers and families, including articles, tips, and community forums, fostering a supportive and informed caregiving community. Overall, utilizing CCI CARE.COM streamlines the process of finding, hiring, and managing caregivers, offering convenience, peace of mind, and support for families seeking care solutions.

Read About(https://businessquasar.com/what-does-tst-mean-on-your-credit-card-statement/)

What’s the “PNP-BILLPAYMENT” Charge?

The “PNP-BILLPAYMENT” charge on your bank statement is a fee related to bill payments processed through the Philippine National Police (PNP) system. It may include payments for various services such as utilities, telecommunications, or government fees.

This charge typically appears when you’ve used a bill payment service offered by the PNP to settle your bills conveniently. Checking your transaction history and verifying the nature of the charge can help ensure accurate record-keeping and budget management. Understanding the “PNP-BILLPAYMENT” charge enables you to track your expenses and stay informed about the services you’ve utilized.

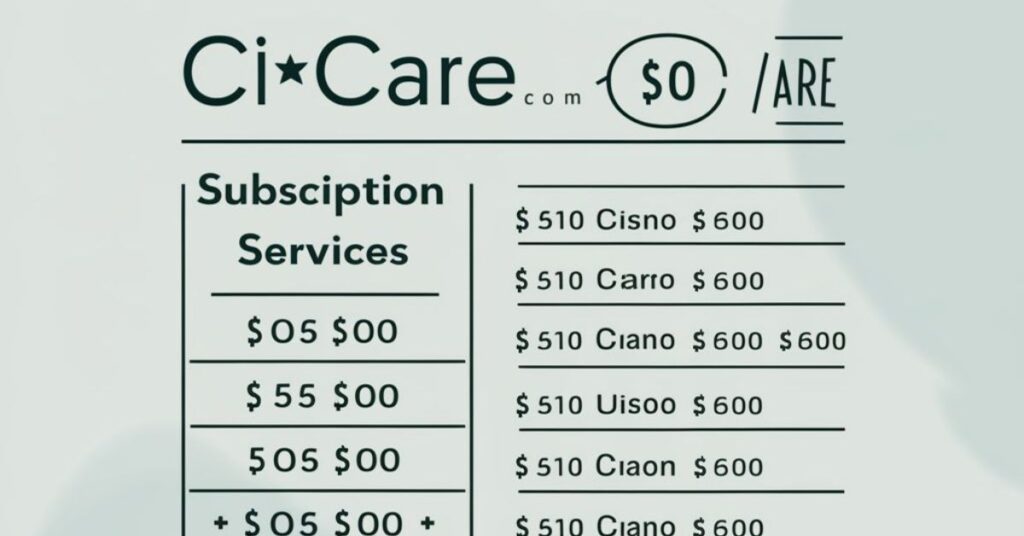

What’s a ” CI*Care.com Charges and Subscription Services

The “CI*Care.com Charges and Subscription Services” on your bank statement refer to fees associated with using Care.com, a platform connecting caregivers with families. These charges cover services like finding caregivers, background checks, and membership fees.

Signing up for Care.com’s subscription services or hiring a caregiver through their platform may result in these charges appearing on your statement. It’s important to review your account activity to ensure the charges are legitimate and match the services you’ve used. Understanding these charges helps you manage your caregiving expenses effectively.

- “CI*Care.com Charges and Subscription Services” encompass fees for utilizing Care.com’s platform.

- These charges may include membership fees, background check costs, and payments to caregivers.

- They appear on your bank statement when you’ve signed up for Care.com’s subscription services or hired a caregiver through their platform.

- Reviewing your account activity ensures that the charges are accurate and align with the services you’ve utilized.

- Understanding these charges enables you to budget effectively and track your caregiving expenses.

Read About(https://businessquasar.com/what-does-tst-mean-on-your-credit-card-statement/)

FID BKG SVC LLC” Charge?

The “FID BKG SVC LLC” charge on your bank statement is associated with Fidelity Brokerage Services LLC, a financial services company offering investment management and brokerage services. This charge may represent fees related to investment transactions, account maintenance, or advisory services provided by Fidelity.

It’s crucial to review your investment accounts and recent transactions to confirm the nature of this charge. Understanding the “FID BKG SVC LLC” charge helps you track your investment-related expenses and ensures accuracy in your financial records.

- “FID BKG SVC LLC” charge relates to Fidelity Brokerage Services LLC, a financial services company.

- It may include fees for investment transactions, account maintenance, or advisory services.

- Review your investment accounts and recent transactions to verify the nature of this charge.

- Understanding this charge helps you track investment-related expenses accurately.

- Contact Fidelity’s customer service for further clarification or assistance regarding the charge.

What’s a “ACH-COMN-CAP-APY-F1” Charge?

The “ACH-COMN-CAP-APY-F1” charge on your bank statement relates to an Automated Clearing House (ACH) transaction for a common capital or annual percentage yield (APY) payment. It’s commonly associated with financial institutions processing electronic payments or transfers.

This charge may represent various financial activities like interest payments, dividends, or other transactions related to your account. Reviewing your recent financial transactions can help verify the purpose of this charge and ensure accuracy in your records.

Understanding the “ACH-COMN-CAP-APY-F1” charge aids in managing your finances effectively and staying informed about your account activity.

Read About(https://businessquasar.com/what-does-tst-mean-on-your-credit-card-statement/)

Concluding Thoughts

The CCI CARE.COM charge on your bank statement is essential for managing your finances effectively and ensuring transparency in your transactions. This charge typically appears when you’ve utilized services from Care.com, a platform connecting caregivers with those in need of care. It may encompass membership fees, background check costs, or payments to caregivers. By reviewing your account activity and confirming that the charge aligns with the services you’ve utilized, you can avoid unexpected expenses and maintain control over your financial records.

Additionally, staying informed about subscription renewals and upcoming charges can help prevent any surprises on your bank statement. Utilizing the services offered by Care.com provides numerous benefits, including access to a diverse network of caregivers, flexible scheduling options, and resources for both caregivers and families. Overall, recognizing the CCI CARE.COM charge empowers you to make informed decisions regarding your caregiving needs while fostering trust and reliability in your financial transactions.