The SEI charge on your bank statement typically refers to a fee levied by financial institutions for providing services related to electronic transfers such as wire transfers online payments or automated clearing house (ACH) transactions. It may appear as a separate line item on your statement indicating the cost incurred for processing these electronic transactions securely and efficiently.

Curious about that SEI charge on your bank statement? Wondering how it impacts your finances? Stay with us as we delve deeper into understanding this often overlooked fee.

What is this charge on my card?

Ever found yourself questioning “What is this charge on my card?” It’s a common dilemma that many encounter when reviewing their bank or credit card statements. These charges can range from legitimate purchases to mysterious fees that leave you scratching your head.

But fear not! Understanding the charges on your card is essential for managing your finances effectively. In this article we’ll dive into the various types of charges you might encounter such as purchases subscriptions fees and fraudulent transactions.

We’ll also provide tips on how to identify each type of charge and take appropriate action if you spot any discrepancies. So, if you’ve ever been puzzled by a charge on your card join us as we unravel the mystery and empower you to take control of your financial transactions.

What is the merchant name on a bank statement?

The merchant name on a bank statement refers to the name of the business or entity that initiated a transaction with your account. It serves as a descriptor of where your money was spent or received providing clarity and accountability for each transaction.

Whether it’s a retail store online service or utility provider the merchant name helps you track your expenses and manage your finances effectively. Understanding the merchant name on your bank statement is crucial for maintaining accurate records and identifying any unauthorized or unfamiliar transactions promptly.

Understanding the SEI Charge: Deciphering Your Bank Statement

The SEI charge on your bank statement is a fee imposed by financial institutions for electronic transaction services like wire transfers online payments or ACH transactions. It appears as a separate line item and reflects the cost of securely processing these transactions. Understanding this charge is essential for managing your finances effectively and avoiding unexpected expenses on your account.

Identification

The SEI charge is often labeled as such on your bank statement, appearing alongside other transaction details.

Purpose

It covers the expenses associated with electronic transfers, ensuring secure and efficient processing of transactions.

Variability

The amount of the SEI charge can vary depending on your bank and the type of electronic transaction being processed.

Frequency

It may appear sporadically on your statement, depending on your transaction activity and banking services utilized.

Impact

While seemingly small, these charges can add up over time, affecting your overall account balance and financial planning.

Importance

Understanding the SEI charge helps you track your banking expenses accurately and budget more effectively.

Demystifying the SEI Charge: What Does It Mean for Your Finances?

Demystifying the SEI charge is essential for financial clarity. This charge often abbreviated as “SEI” on bank statements pertains to Service Endpoint Identifier a term used in electronic payment systems. It represents fees incurred for electronic transactions like wire transfers ACH transfers or online payments.

Here’s a breakdown of what the SEI charge means for your finances

- SEI charge is a fee applied by financial institutions for processing electronic transactions securely and efficiently.

- It covers the costs associated with providing electronic transfer services such as maintaining secure networks and processing payments.

- The SEI charge may vary depending on the type and frequency of electronic transactions made through your account.

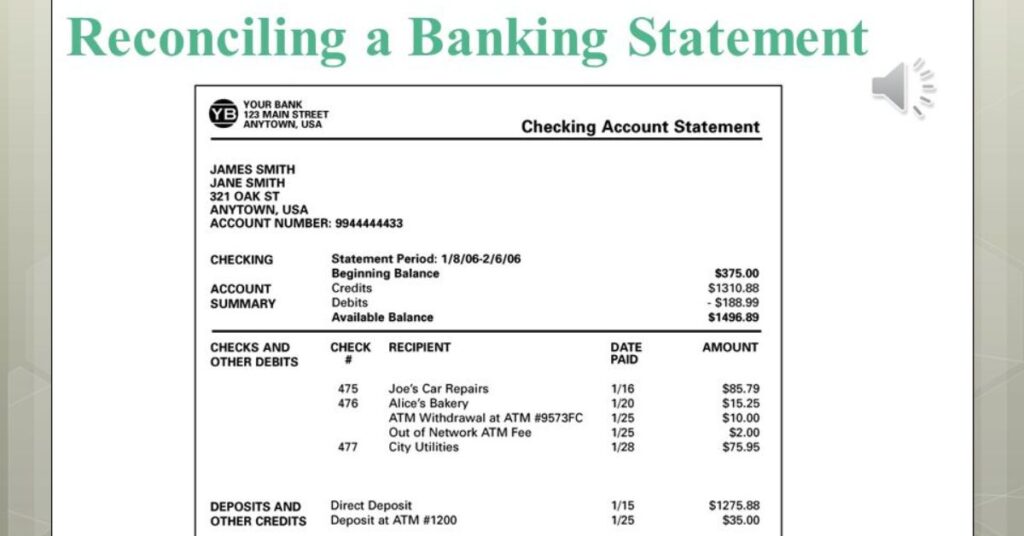

- It’s important to review your bank statements regularly to identify SEI charges and understand how they contribute to your overall banking expenses.

- By understanding the SEI charge you can make informed decisions about your financial transactions and manage your accounts more effectively.

Read More …https://businessquasar.com/can-a-landlord-charge-for-eviction-fees-your-obligations/

Making Sense of the SEI Charge: How Does It Affect Your Account?

Making sense of the SEI charge involves understanding its impact on your account balance and financial transactions. This fee often incurred for electronic transfers can add up over time affecting your overall account balance and potentially influencing your budgeting decisions. By recognizing how the SEI charge affects your account you can make informed choices about your banking activities exploring alternatives or adjustments to minimize its impact and optimize your financial management.

Delving into the SEI Charge: What You Need to Know About This Banking Fee

Delving into the SEI charge reveals crucial information about this banking fee that every account holder should know. The SEI charge often found on bank statements stands for Service Exchange Interface. It represents the cost incurred by financial institutions for facilitating electronic transactions such as wire transfers online payments, and ACH transfers.

The SEI charge is essential as it directly impacts your financial transactions and account balance. It’s important to note that the SEI charge can vary between banks and may be assessed differently based on the type and frequency of electronic transactions you conduct. Being informed about the SEI charge empowers you to make strategic decisions about your banking activities including exploring alternative payment methods or negotiating fee waivers with your bank.

Mastering Your Bank Statement: Understanding the SEI Charge and Its Implications

Mastering your bank statement involves gaining a comprehensive understanding of the SEI charge and its implications for your financial health. The SEI charge often listed as a fee for electronic transactions on your statement encompasses various services such as wire transfers online payments and ACH transactions. Its implications extend beyond mere transactional details impacting your account balance budgeting decisions and overall financial strategy.

By grasping the significance of the SEI charge you can effectively evaluate its impact on your financial well being. Understanding its implications empowers you to make informed decisions about your banking activities exploring alternatives, negotiating fees or adjusting your financial habits accordingly.

Furthermore mastering the management of the SEI charge enhances your ability to optimize your banking experience minimize unnecessary expenses and maintain greater control over your financial future.

Read More …https://businessquasar.com/can-a-landlord-charge-for-eviction-fees-your-obligations/

Frequency Asked Question For The SEI Charge on Your Bank Statement

What is the SEI charge on my bank statement?

The SEI charge typically refers to a fee assessed by financial institutions for electronic transactions like wire transfers, online payments, and ACH transactions.

How much does the SEI charge usually cost?

The cost of the SEI charge varies depending on your bank and the specific transaction types. It can range from a few dollars to a percentage of the transaction amount.

Why am I being charged an SEI fee?

You’re charged an SEI fee for the convenience and security of electronic transactions processed by your bank. It covers the operational costs associated with handling these transactions efficiently.

Can I avoid the SEI charge?

Avoiding the SEI charge may be possible by opting for alternative payment methods or choosing accounts with lower transaction fees. Some banks offer fee waivers under certain conditions, such as maintaining a minimum balance.

How can I dispute an SEI charge on my statement?

If you believe an SEI charge on your bank statement is incorrect or unauthorized, contact your bank’s customer service immediately to dispute the charge. Provide relevant details and documentation to support your claim, and the bank will investigate the issue and provide a resolution.

Conclusion

Understanding the SEI charge on your bank statement is crucial for managing your finances effectively. This fee often associated with electronic transactions impacts your account balance and financial decisions.

By familiarizing yourself with the implications of the SEI charge you can make informed choices about your banking activities explore alternatives to minimize fees and maintain greater control over your financial well being.

Remember to regularly review your bank statements inquire about any unfamiliar charges, and take proactive steps to optimize your banking experience. With knowledge and awareness, you can navigate the intricacies of the SEI charge and ensure sound financial management in the long run.